This topic describes these two close concepts and contrasts different ways which are however used for.

Prepayment is when money has been paid upfront for something andagainst an issued document. Overpayment is when too much money has been paid.

Also to record prepayments and overpayments different general ledger accounts are applied.

Prepayments (or advance payments)

In case of sales, prepayment workflow is usually based on issuing a proforma invoice, receiving the money, issuing a final invoice and then offsetting the received prepayment.

After the entire transaction is complete, the status of the proforma invoice can be changed from Paid to Closed by clicking on the “Mark as Done” button.

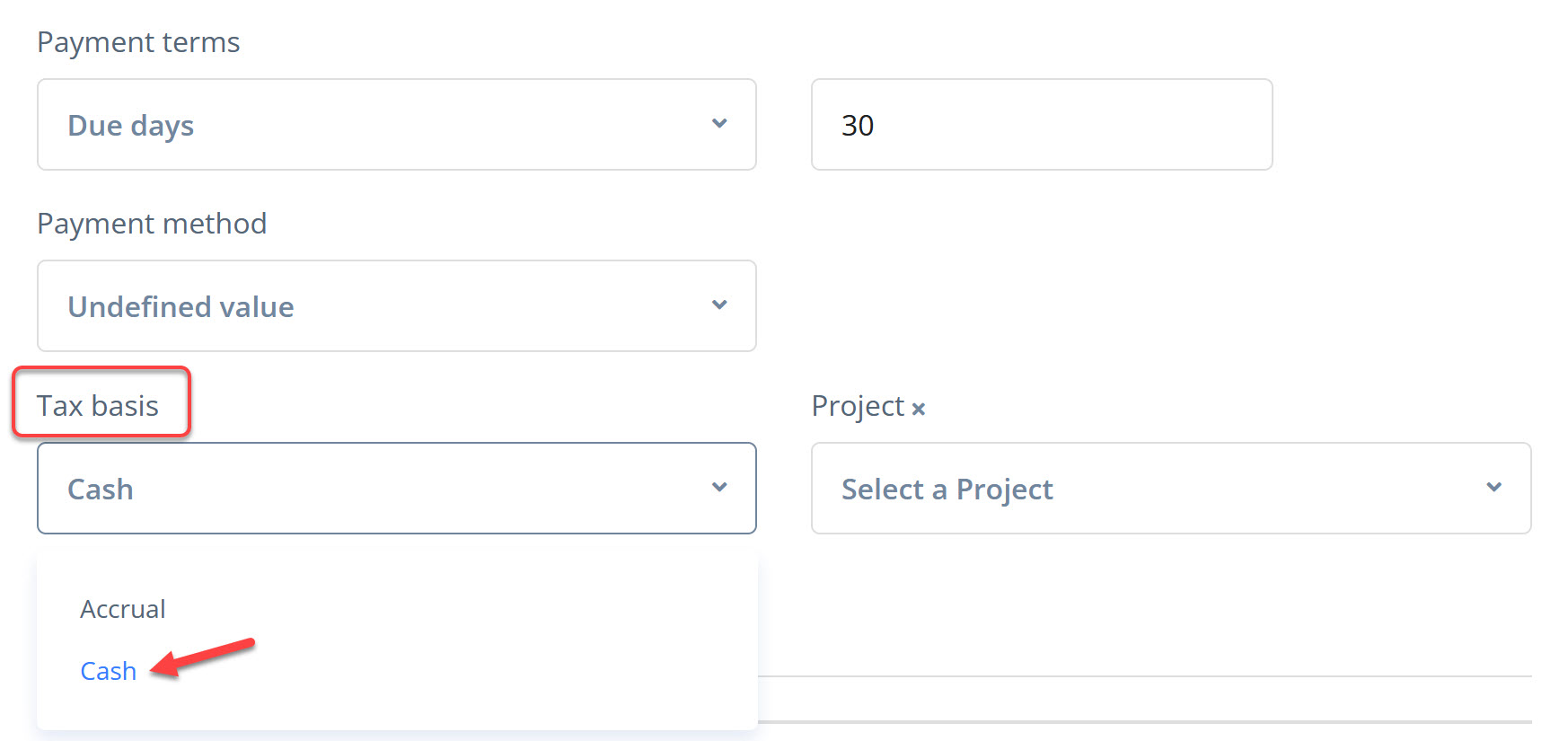

The automatic calculation and posting of VAT amount at the time of receipt of prepayments is supported by the program (in the case of the cash method was selected in the prepayment invoice).

Overpayments

Overpayments are usually revealed and recorded in the process of bank reconciliation. For example, when you receive money from a customer in case he has paid you more than he owes you in total. Thus, the received amount (or part of it) cannot be attributed to any document (proforma, outstanding invoice etc.).

In order to record the overpaid amount there is a corresponding button "Add as overpayment" in the payment form.

When issuing an invoice, an existing overpayment can be set off at the time of invoicing (checkbox "Use Overpayment") or afterwards as one of the payment options.

Both overpayments and prepayments are highlighted as separate lines in the Balance Confirmation with partner.

You may view list of all overpayments in the partner’s Statement by selecting an overpayment account.

All default accounts, including those for prepayments and overpayments, are available for viewing and editing under My Company -> Settings -> Accounting -> Default Accounts.

FAQs

Prepayment is when money has been paid upfront for something and against an issued document. Overpayment is when too much money has been paid.

What is an example of an overpayment? ›

The following is a simplified example of a gross overpayment amount and paycheck reduction: Example: Employee A was paid $500 on their check for the 1/31 pay period. Employee A should have been paid $400. This results in a gross overpayment of $100.

How is an overpayment treated in accounting? ›

If accrual accounting is used, the overpayment represents a future obligation and is recorded as a contra-asset that reduces the accounts receivable balance. If cash accounting is used, the overpayment would be recorded as a liability under customer deposits or prepayments.

What is the meaning of prepayment? ›

Definition of 'prepayment'

A prepayment is a payment that you make before you receive goods or services, or before a debt is due. If a borrower makes prepayments, the loan balance declines more rapidly than would otherwise be possible. During periods of rising interest rates, the rate of prepayments generally declines.

How do you account for overpayments to a vendor? ›

If the invoice is from a regular supplier, the easiest solution is often to apply the overpayment to a new or existing invoice. Other options include refunding the overpayment or being given a credit note that you can allocate against a future invoice.

What is the difference between prepayment and overpayment? ›

This topic describes these two close concepts and contrasts different ways which are however used for. Prepayment is when money has been paid upfront for something and against an issued document. Overpayment is when too much money has been paid.

What is meant by overpayment? ›

An overpayment occurs when someone pays more than the required or agreed-upon amount for a product or service. It can happen due to various reasons, such as a billing error, incorrect calculations, or misunderstandings between the payer and the recipient.

What are prepayments examples? ›

Some examples of prepayment include: Purchasing goods or services as prepaid assets: you might purchase office supplies in bulk, for instance, and pay for them upfront. Repaying the interest on a business loan: you might take out a loan, and make an upfront payment to cover the first few months' worth of interest.

What are considered prepayments? ›

A prepaid expense is an expense that is paid for in advance. Recurring expenses such as insurance and rent can be paid for with one payment that covers the cost of the expense for several months or even a year. Often, businesses prepay expenses in this manner because they can receive a discount.

How do you explain prepayments? ›

Prepayments are amounts paid for by a business in advance of the goods or services being received later on. Any payment made in advance can be considered a prepayment.

WordReference English Thesaurus © 2024. Synonyms: overcharge, too much, excessive payment, money , payment.

How should overpayments be recorded? ›

An unintentional overpayment by the customer is a credit to his AR balance. However, too many credit balances skew the true AR balance and need to be reclassified. You would debit the AR balance and credit a liability account. All overpayments are liabilities until a refund is issued, or the amount is eshceated.

How do you record overpayments to suppliers? ›

The most common way is to create a journal entry to record the amount of the overpayment and the corresponding invoice number. Another method is to credit the supplier's account with the overpayment amount, and then debited the account for the corresponding invoice.

What are examples of overpay? ›

Examples of 'overpay' in a sentence

- You can also ask for any overpaid tax to be refunded.

- Two thirds had no idea how to claim back overpaid tax.

- Those who have argued for years that footballers are overpaid may soon have their moment.

- There are many other situations where overpaid tax can be lost.

A legally defined overpayment (LDO) is a payment made to an individual that was more than the amount we should have paid the individual under Title II of the Act.

Which two types of payments can be included in an overpayment? ›

A benefit overpayment is when you collect unemployment, disability, or Paid Family Leave (PFL) benefits you are not eligible to receive.

Am I obligated to pay back an overpayment? ›

California offers the strongest worker protections against bosses clawing back money that they think was overpaid. First, an employer can only recoup money if the worker signs a written agreement outlining the exact terms of repayment.